|

What is free credit period? |

|

When you use your credit card to make payments, you are in effect borrowing money on credit from the

bank and repaying it at a later date. Free credit period is the period for which customers can avail of the

credit card facility without having to pay finance charges. |

|

The maximum free credit period availed can be 52 days (where full payment is made by the Payment Due Date for the previous month). Example: Assume that your statement date is the 2nd of every month. Your

2 Sep statement will contain all your transactions that have been billed between 3 Aug and 2 Sep, and you have to pay in 22 days time. Therefore, if you make a transaction on your card on 3 Sep, it will appear in the statement of 2 Oct and payment due will be 22 days thereafter, that is, 24 Oct. Free credit period in this

case is 3 Sep to 24 Oct 2009 (52 days) |

|

What is the “extended credit / revolving” facility ? |

|

The Total Payment Due for the month is mentioned in your monthly credit card statement. However, instead of making a full payment you may choose to pay a lesser amount. The unpaid amount is the extended

credit / revolved amount. |

|

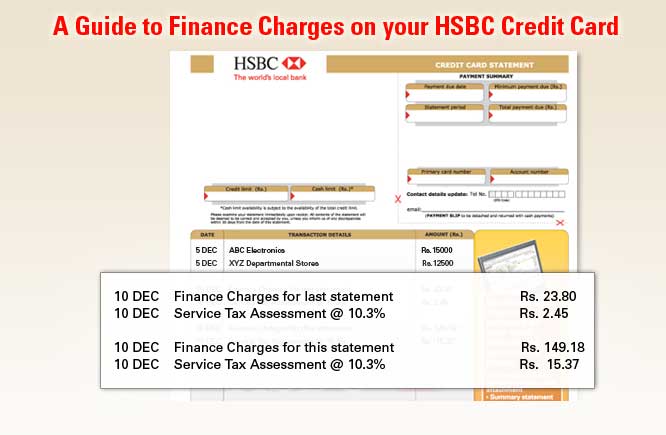

Why is Finance Charge levied on my credit card? |

|

Finance Charge is the interest amount levied for availing the extended credit facility. |

|

What does the finance charge levied depend upon? |

|

Finance Charge levied depends upon the amount that is outstanding (unpaid), the number of days for

which the amount is outstanding and the interest rate applicable on your HSBC credit card. For a detailed description please refer to the finance charge example in Appendix A below. |

|

For what period is the Finance Charge levied? |

|

Finance Charge is levied for the period from the date of the transaction to the statement date. For example:

If your statement date is 2nd of the month and you have made a purchase on 15 Aug. Finance Charge if levied for this transaction will be calculated for the period 15 Aug to 2 Sep (18 days). |

|

When is the free credit period not applicable? |

|

When a customer is availing of the extended credit facility on HSBC credit card (i.e. a full payment

is not made by the payment due date of the last statement), any new transaction made in the current

statement will be levied with finance charges with immediate effect. Free credit period is also not

applicable for Cash Advance transactions and revolving balances on your HSBC credit card. |

|

How can I avail of the free credit period? |

|

You should ensure that you make payment equal to the Total Payment Due by the Payment Due Date.

Then you can avail of free credit period on your transactions done during the next statement cycle

provided the payment is realized on or before the payment due date. |

|

What is Minimum Payment Due (MPD)? |

|

MPD for a month is the minimum amount that must be paid to avoid levy of Late Payment Fee. MPD is calculated as a percentage of the Total Payment Due + the Monthly EMI amounts (if any). |

|

How are EMIs treated for purpose of Finance Charge? |

|

If you have availed of an installment repayment facility (Loan on Phone, Balance Transfer on EMI,

Cash-on-EMI etc) on your credit card, the EMI will be billed every month in your statement. The EMI

due for the month is included as part of the Minimum Payment Due appearing in the credit cardholders

statement. If only the Minimum Payment Due (as defined above) is paid, the standard credit card

interest rates will be levied on the outstanding balance amount. However, if such partial payments

do not cover the amount of EMI for the month, the balance EMI would also be subject to the applicable

Finance Charge (including the Late Payment Fee). |